A coalition of the UK’s leading steel producers and members of the metal recycling industry has today published a report urging governments across the UK to act quickly to unlock the full economic and environmental potential of the UK’s steel scrap.

The report by the Circular Steel Sub-Committee of trade body, UK Steel, entitled Circular Steel: Strengthening the UK’s Industrial Supply Chain, highlights a fundamental challenge within the metal recycling and steel sectors:

It is currently cheaper to export steel scrap and import steel products made abroad than to process the scrap and manufacture steel goods from it domestically.

The UK has an abundance of readily available steel scrap, producing approximately 10 million tonnes per annum. Currently, more than 80 percent of that resource is being exported and much of that material then returns to the UK in the form of finished goods, undercutting domestic processors and manufacturers and exporting jobs and emissions.

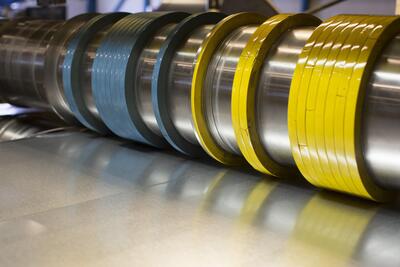

The absence of large-scale, scrap-intensive, electric arc furnace (EAF) steel production in the UK has meant that a strong domestic market for high-quality steel scrap has never had the opportunity to develop, until now.

As the UK transitions to EAF technology, high-quality domestic steel scrap will become the cornerstone of low-carbon steel production. But, without urgent reform, industry leaders caution that the UK risks outsourcing jobs, economic value and emissions to its global competitors.

The report identifies a number of structural challenges that inhibit the UK industry’s ability to capitalise on the country’s steel scrap potential - from insufficient domestic processing capacity and high industrial energy costs to inconsistent quality and enforcement standards across the metals recycling supply chain.

To address these barriers, the Circular Steel Sub-Committee is urging a combined effort from governments and regulators to align fiscal, environmental, and energy policy to foster a thriving domestic market for steel scrap and recycled steel. At the heart of the proposals is an industry-led Code of Standards, designed to enhance quality assurance and traceability, to lay the groundwork for future national standards.

Targeted cross-government support and intervention will complement industry action and lay the foundation for a competitive, sustainable, and resilient UK steel industry. The report recommends governments:

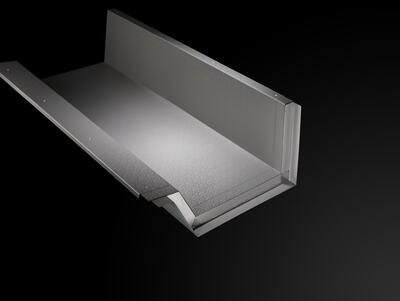

- Support investment in domestic scrap processing infrastructure, such as shredding, screening, and refining to meet EAF-grade standards, such as those that will be required at Tata Steel UK’s Port Talbot site.

- Address cost disparities between domestic and export markets, creating fairer market conditions.

- Introduce national definitions and standards for EAF-grade steel scrap, ensuring consistency and reliability across the supply chain.

- Modernise regulatory oversight, including unified licensing and inspections for recyclers.

- Include metal recovery recyclers in the British Industrial Competitiveness Scheme, to reduce energy costs and support product and market transformation.

Jacob Hayler, Chair of the Circular Steel Sub-Committee, said:

“The UK’s steel scrap resource is one of our greatest industrial assets, but the policy framework that drives the market has not kept pace with the shift to low-CO2 production.

"It costs less to export steel scrap for processing and manufacture abroad then re-import those steel products, than it does to process and manufacture it domestically. That must change if we are to retain jobs, encourage investment, and support resilience in the UK’s manufacturing base.

“The UK has the scrap, the skills, and the ambition to be a global leader in circular steel. Benefits for the steel industry, the recycling industry, for jobs, growth and the environment are within our grasp. What we need now is coordinated policy leadership to align with national climate, industrial and competitiveness objectives.”

Tony Hayer, Managing Director of S. Norton Group said:

“Recycling is the backbone of EAF steelmaking, but the system must evolve to meet the needs of a modern, low-carbon economy.

"With the right policies on energy pricing, regulation, and infrastructure investment, we can build a competitive domestic recycling base that keeps value, jobs and carbon savings in the UK.”

Donald Ward, Operations Director at Ward, said:

“For recyclers, the opportunity is clear: we need a system that recognises and rewards quality, traceability and responsible management of steel scrap.

A domestic market built on those foundations will not only give UK steelmakers the feedstock certainty they need, but also generate a robust supply chains and sustainable skilled employment across the UK.”

Rajesh Nair, Chief Executive Officer of Tata Steel UK and Chair of UK Steel, said:

“The UK’s shift to EAF production is a once-in-a-generation opportunity to revitalise UK steelmaking and drive long-term industrial growth. To seize it, we must build a competitive domestic steel scrap supply chain that supports investment, strengthens our manufacturing base, and keeps more economic value in the UK.

A circular materials strategy, backed by smart policy, will help position the UK as a leader in the global circular steel economy.”

Carles Rovira, Chief Executive Officer of 7-Steel UK, said:

“At 7 Steel, we’ve built our business around EAF technology for over two decades – it’s not just a transition, it’s our foundation.

The UK’s broader shift to EAF represents a generational chance to reshape steelmaking for a low-carbon future. But to realise its full potential, we need a resilient domestic steel scrap supply chain supported by Government policy embedding a joined-up circular materials approach.

These are the levers that will unlock investment, strengthen UK manufacturing, and ensure the economic value of steel stays rooted in our communities.”

Commenting on the launch of the report, UK Steel Director-General Gareth Stace said:

"The supply and quality of steel scrap is critical to the future of low-emission steel in our country. Whilst we enjoy a surplus of scrap, here in the UK, the vast bulk of it is exported, unsorted and of low quality. For the benefit of the whole steel supply chain, this situation needs to change.

"Today’s report, formulated jointly by the recycling and steel industries, lays out a clear set of sensible steps to help ensure that we can work together to support our sector’s net zero ambitions, and secure the supply and quality of this vital raw material, long into the future.”

The report, Circular Steel: Strengthening the UK’s Industrial Supply Chain, can be found here.

For further information:

Tim Rutter, Director Communications & Public Affairs, Tata Steel UK: tim.rutter@tatasteeleurope.com or 07850990755

Jo Milligan, Head of Public Affairs, EMR: jo.milligan@emrgroup.com or 07798891637

About the Circular Steel Sub-Committee

- Established in September 2025 under UK Steel, the Circular Steel Sub-Committee brings together leading steel producers, metal recyclers, and independent experts, to develop practical, evidence-based policy proposals that support the UK’s transition to a sustainable and circular steel economy.

About Tata Steel UK

- The Tata Steel Group has been named one of the most ethical companies in the world, and is among the top producing global steel companies with an annual crude steel capacity of 34 million tonnes.

- Tata Steel in the UK has the ambition to produce net-zero steel by 2045 at the latest, and to have reduced 30% of its CO2 emissions by 2030.

- In October 2024, Tata Steel ceased ironmaking at its Port Talbot site and temporarily paused steelmaking pending the construction of a 3.2Mtpa Electric Arc Furnace, due to be commissioned late in 2027 / early 2028. For that period, the business will import slab and hot rolled coil to support manufacturing and distribution operations at sites across Wales, England and Northern Ireland as well as Norway, Sweden, France, Germany and UAE. It also benefits from a network of sales offices around the world.

- Throughout 2024 Tata Steel UK has been undergoing a restructuring that will reduce the size of its workforce to around 5000 direct employees, supplying high-quality steel products to demanding markets, including construction and infrastructure, automotive, packaging and engineering.

- Tata Steel Group is one of the world's most geographically-diversified steel producers, with operations and a commercial presence across the world.

- The group recorded a consolidated turnover of around US$27.7 billion in the financial year ending March 31, 2024.