UK Government adopts steel recommendations on energy

Following the publishing of the UK Government's Industrial Strategy, the UK steel industry has welcomed the decision to reduce energy costs, but says there is still much to do.

"UK power prices have for too long damaged the profitability and growth of the steel industry hand over fist, driving away investment and opportunities decarbonise our production."

The recommendations adopted include:

- Increase of Network Charging Compensation to 90% from 2026, matching what is provided in Germany and France – This will reduce power prices by an estimated £6.5/MWh and save the steel industry £14.5m per year.

- Continuation of the indirect compensation scheme, which compensates the steel industry for the carbon taxes paid via the electricity bills – If this had not been renewed, industrial electricity would have increased by £20/MWh and increased electricity bills by £45m for the steel sector.

- British Industrial Competitiveness Scheme from 2027, which will provide an exemption for Renewables Obligation, Feed-in Tariffs and the Capacity Market for less electro-intensive businesses – UK Steel estimates that this will reduce power prices for eligible manufacturers by £43/MWh, which the Government states would represent up to 25% of manufacturers electricity bills

The uplift to Network Charging Compensation from 60% to 90% in line with what is provided in Germany will reduce industrial electricity prices by £6.5 per megawatt hour (MWh) for the steel industry – an incredible £14.5 million per year.

Despite this impactful cut to electricity costs, there remains a £10-16 per MWh difference between European electricity costs, which slaps £36 million per year on steel bills. The reason for the energy intensive industries disparity is wholesale electricity costs, driven by the UK’s reliance on natural gas power generation.

Tackling network charges, indirect compensation and the new British Industrial Competitiveness Scheme are welcome steps on the road to creating affordable energy and an effective business environment. UK Steel has the solution to eliminate industrial electricity price disparities between the UK and its European competitors. In collaboration with the respected energy consultancy Baringa, UK Steel proposed the introduction of a two-way Contract-for-Difference to peg wholesale prices to those in France and Germany, thereby eradicating the price disparity.

"The Industrial Strategy must be the first of many changes if we are to fully unlock the potential of the UK steel industry to back the growth and stability of our economy"

Gareth Stace, Director General at UK Steel, said: “The Government has rightly taken action to reduce industrial electricity prices and modelled its new policies on UK Steel’s solutions. UK power prices have for too long damaged the profitability and growth of the steel industry hand over fist, driving away investment and opportunities decarbonise our production.

"The Industrial Strategy is a step in the right direction towards competitive electricity prices and a better, more effective business landscape, but we are climbing slowly up the foothills of the mountain we need to climb. This is an important milestone, but we are not out of the trenches yet. The Industrial Strategy must be the first of many changes if we are to fully unlock the potential of the UK steel industry to back the growth and stability of our economy.”

Tom Evans, Head of Public Affairs for Tata Steel UK said: “We are pleased the UK Government has recognised the challenge that high energy costs pose for energy-intensive industries such as ours, and that they have accepted our call for further relief on Network energy costs. But significant further action is needed as fundamental challenges remain - UK steelmakers still face electricity prices up to 50% higher than their European competitors.

"There remain many challenges for our industry, not least the urgent need for UK-specific trade measures in light of huge global overcapacity and the trade diversions caused by US tariffs on steel.”

“We urge government to consider our industry’s ‘Contract for Difference’ proposals that would provide long-term price stability, unlock investment in further low-carbon technologies, and ensure a level playing field as the UK steel industry transitions to electric arc furnace steelmaking.

“Whilst we continue to work positively and collaboratively with governments, industry peers and academia, and to invest heavily in UK manufacturing, there remain many challenges for our industry, not least the urgent need for UK-specific trade measures in light of huge global overcapacity and the trade diversions caused by US tariffs on steel.”

NOTES

- UK steel producers still pay around £68/MWh for electricity, compared to £44/MWh in France and £52/MWh in Germany - up to 50 percent more than those competitors.

- This disparity arises from higher wholesale electricity prices in the UK due to a high proportion of gas in the UK power mix, and lower levels of state support for energy costs.

- To bring down energy prices, the steel industry has proposed a two-way Contract for Difference (CfD) mechanism, which would ensure price parity with the lowest-cost European producers by fixing electricity prices for the steel sector.

- This would protect against price volatility, allowing long-term planning and future investment in low-carbon technologies, and share risk and reward, with the sector paying back the government when prices fall below the agreed strike price.

About Tata Steel UK

- The Tata Steel Group has been named one of the most ethical companies in the world, and is among the top producing global steel companies with an annual crude steel capacity of 34 million tonnes.

Tata Steel in the UK has the ambition to produce net-zero steel by 2045 at the latest, and to have reduced 30% of its CO2 emissions by 2030. - In October 2024, Tata Steel ceased ironmaking at its Port Talbot site and temporarily paused steelmaking pending the construction of a 3.2Mtpa Electric Arc Furnace, due to be commissioned late in 2027 / early 2028. For that period, the business will import slab and hot rolled coil to support manufacturing and distribution operations at sites across Wales, England and Northern Ireland as well as Norway, Sweden, France, Germany and UAE. It also benefits from a network of sales offices around the world.

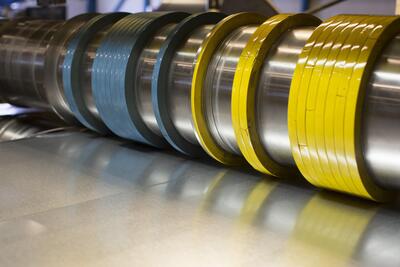

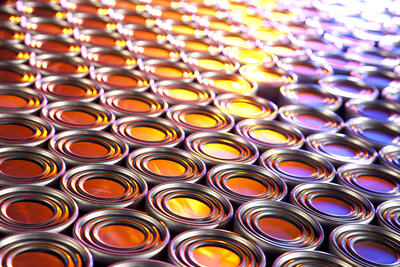

- Throughout 2024 Tata Steel UK has been undergoing a restructuring that will reduce the size of its workforce to around 5000 direct employees, supplying high-quality steel products to demanding markets, including construction and infrastructure, automotive, packaging and engineering.

- Tata Steel Group is one of the world's most geographically-diversified steel producers, with operations and a commercial presence across the world.

The group recorded a consolidated turnover of around US$26 billion in the financial year ending March 31, 2025.