In Tata Steel's Quarter 2 results announced today, Chief Executive Officer and Managing Director TV Narendran reflected on a 'complex global operating environment.'

Mr TV Narendran said: “Global operating environment remained complex, with key regions facing subdued growth. Macro-economic conditions in China continued to weigh on commodity prices including steel.

Of the UK business, Mr Narendran said: "Quarter 2 marked the closure of our blast furnaces in UK. We have signed the grant funding agreement with the UK government and are progressing on the proposed transition to green steel. We remain fully committed to supporting affected employees and have offered the best ever package of support in Tata Steel UK."

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer added: With respect to the UK transition, we have signed a contract with Tenova to deliver a state-of the-art Electric Arc Furnace. We have completed public consultation on the planning application and anticipate commencing large scale site work around July 2025.

"Our performance in UK and Netherlands was adversely impacted by the compression in steel spreads. Further, UK was also weighed by the transitory nature of operations as the blast furnaces were safely decommissioned and steel stock was built up to operate downstream.

"During our transition to green steel, we will operate our downstream operations by sourcing substrate. This will help us sustain our significant market presence across steel end use segments in UK."

UK operating results

During the quarter, revenues were £600 million and EBITDA loss stood at £147 million. Liquid steel production was 0.39 million tons while deliveries were 0.63 million tons. On half year basis, Revenues were £1,246 million and EBITDA loss was £238 million.

Read their full statements here:

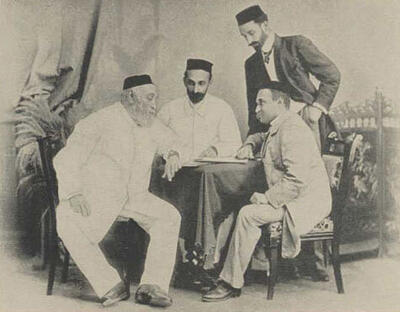

Mr. T V Narendran, Chief Executive Officer & Managing Director:

“Global operating environment remained complex, with key regions facing subdued growth. Macro-economic conditions in China continued to weigh on commodity prices including steel. In India, steel demand continued to improve but domestic prices were under pressure due to cheap imports. Despite this, Tata Steel has delivered broadly consistent performance, with India deliveries at 5.1 million tons for the quarter and 10.1 million tons for the half year. Domestic deliveries rose by 6% for the quarter and 5% for the half year on YoY basis. Among business verticals, automotive deliveries were aided by growth in hi-end products.

"Tata Tiscon achieved ‘best ever 2Q’ deliveries and was up 20% YoY. In September 2024, we successfully commissioned the 5 MTPA blast furnace at Kalinganagar. This coupled with the 2.2 MTPA CRM complex will further improve our product mix.

"2Q also marked the closure of our blast furnaces in UK. We have signed the grant funding agreement with the UK government and are progressing on the proposed transition to green steel. We remain fully committed to supporting affected employees and have offered the best ever package of support in Tata Steel UK.

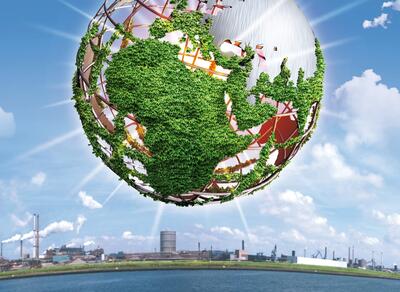

"In Netherlands, our deliveries stood at 1.5 million tons and subdued steel prices weighed on performance. We are undertaking pilot projects to avoid or convert captured carbon emissions.

"I am happy to share that we have achieved 20% diversity for the first time in India and have also been recognised by worldsteel for process safety management.”

Mr. Koushik Chatterjee, Executive Director and Chief Financial Officer:

“Tata Steel Consolidated revenues for the half year were Rs 1,08,676 crores and EBITDA was Rs 13,046 crores. Consolidated EBITDA margin witnessed an improvement of around 300 bps to 12%, aided by higher volumes in India and improved profitability at Netherlands. This was despite challenging operating environment across geographies. Consolidated revenues for the quarter stood at Rs 53,905 crores and EBITDA was Rs 6,224 crores, which translates to a margin of 12%. India revenues were around Rs 32,660 crores and margin of 21% works out to an EBITDA of Rs 6,912 crores.

"Our second blast furnace at Kalinganagar is ramping up well and associated facilities such as Continuous Annealing Line and Air Separation Unit will be commissioned in the later part of the year. Separately, we have placed equipment orders for our 0.85 MTPA Electric Arc Furnace plant in Ludhiana.

"Our performance in UK and Netherlands was adversely impacted by the compression in steel spreads. Further, UK was also weighed by the transitory nature of operations as the blast furnaces were safely decommissioned and steel stock was built up to operate downstream.

"We spent around Rs 8,583 crores on capital expenditure during the half year, mostly in India. Our net debt stands at Rs 88,817 crores and the group liquidity position remains strong at Rs 26,028 crores, with cash and cash equivalents of Rs 10,575 crores. We are focused on cost optimisation, operational improvements and working capital management to maximise cashflows. With respect to the UK transition, we have signed a contract with Tenova to deliver a state-of the-art Electric Arc Furnace. We have completed public consultation on the planning application and anticipate commencing large scale site work around July 2025. During our transition to green steel, we will operate our downstream operations by sourcing substrate. This will help us sustain our significant market presence across steel end use segments in UK. In Netherlands, we are engaged with the government on support for the decarbonisation of our operations.”

Results highlights

Tata Steel reports Consolidated EBITDA of Rs 6,224 crores for the quarter and Rs 13,046 crores for the half year ended September 30, 2024

- Consolidated Revenues for 1HFY25 were Rs 1,08,676 crores. EBITDA improved by 25% YoY to Rs 13,046 crores with an EBITDA margin of 12%.

- Consolidated Revenues for the July – Sep 2024 quarter were Rs 53,905 crores and EBITDA was Rs 6,224 crores with an EBITDA margin of around 12%.

- The company has spent Rs 4,806 crores on capital expenditure during the quarter and Rs 8,583 crores for the half year.

- Net debt stands at Rs 88,817 crores. Our group liquidity remains strong at Rs 26,028 crores, which includes cash & cash equivalents of Rs 10,575 crores.

- India2 revenues were Rs 32,660 crores for the quarter and EBITDA was Rs 6,912 crores, which translates to an EBITDA margin of 21%. Crude steel production was 5.28 million tons and was up 5% on YoY basis. Deliveries stood at 5.11 million tons and were up on YoY basis, driven by 6% rise in domestic deliveries.

- On half year basis, Revenues were Rs 65,853 crores and EBITDA was Rs 13,946 crores.

- In September 2024, we successfully commissioned India’s largest blast furnace at Kalinganagar. With ramp up of Kalinganagar facilities, India crude steel capacity will increase to 26.6 MTPA.

- In UK, the remaining blast furnace at Port Talbot was closed to pave the way for next generation of green steelmaking. During the quarter, revenues were £600 million and EBITDA loss stood at £147 million. Liquid steel production was 0.39 million tons while deliveries were 0.63 million tons.

- On half year basis, Revenues were £1,246 million and EBITDA loss was £238 million.

- Netherlands revenues were £1,300 million and EBITDA for the quarter was £22 million. Liquid steel production at 1.66 million tons and deliveries at 1.50 million tons, were up on YoY basis.

- On half year basis, Revenues were £2,644 million and EBITDA was £65 million.

About Tata Steel

• Tata Steel group is among the top global steel companies with an annual crude steel capacity of 35 million tonnes per annum.

• It is one of the world's most geographically diversified steel producers, with operations and commercial presence across the world.

• The group recorded a consolidated turnover of around US$27.7 billion in the financial year ending March 31, 2024.

• A Great Place to Work-CertifiedTM organisation, Tata Steel Limited, together with its subsidiaries, associates, and joint ventures, is spread across five continents with an employee base of over 78,000.

• Tata Steel has announced its major sustainability objectives including Net Zero by 2045.

• The Company has been on a multi-year digital-enabled business transformation journey intending to be the leader in ‘Digital Steel making’. The Company has received the World Economic Forum’s Global Lighthouse recognition for its Jamshedpur, Kalinganagar, and IJmuiden Plants. Tata Steel has also been recognised with the ‘Digital Enterprise of India – Steel’ Award 2024 by Economic Times CIO.

• The Company has been recognised with the World Economic Forum’s Global Diversity Equity & Inclusion Lighthouse 2023.

• The Company has been a part of the DJSI Emerging Markets Index since 2012 and has been consistently ranked among the top 10 steel companies in the DJSI Corporate Sustainability Assessment since 2016.

• Tata Steel’s Jamshedpur Plant is India’s first site to receive ResponsibleSteelTM Certification. Subsequently, its Kalinganagar and Meramandali plants have also received the certification. In India, Tata Steel now has more than 90% of its steel production from ResponsibleSteelTM certified sites.

• Received Prime Minister’s Trophy for the best performing integrated steel plant for 2016-17, 2024 Steel Sustainability Champion recognition from worldsteel for seven years in a row, 2023 Climate Change Leadership Award by CDP, Top performer in Iron and Steel sector in Dun & Bradstreet's India's top 500 companies 2022, Ranked as the 2024 most valuable Mining and Metals brand in India by Brand Finance, ‘Most Ethical Company’ award 2021 from Ethisphere Institute, and ‘Best Corporate for Promotion of Sports’ recognition at the Sportstar Aces Awards 2024.

• Received the 2023 Global ERM (Enterprise Risk Management) Award of Distinction at the RIMS ERM Conference 2023, ‘Masters of Risk’ - Metals & Mining Sector recognition at The India Risk Management Awards for the eighth consecutive year, and ICSI Business Responsibility and Sustainability Award 2023 for its first Business Responsibility and Sustainability Report (BRSR), Excellence in Financial Reporting FY20 from ICAI, among several others.

Follow us on social media