Over recent weeks, we’ve seen some significant milestones for the UK steel industry, with the Government announcing a series of major policy steps that reflect a stronger, more coordinated approach to supporting the industry.

From energy price support to trade protections and procurement reform, these moves represent important steps towards building a competitive and resilient future for the sector.

Key highlights include:

1. An Industrial Strategy – including expanded energy support for Energy Intensive Industries including steel

As part of the wider Industrial Strategy, the Government confirmed a package of reforms that will significantly reduce electricity costs for energy-intensive manufacturers, including steel producers. This includes increasing network charging compensation to 90% from 2026, extending the Indirect Cost Compensation scheme, and introducing a new British Industrial Competitiveness Scheme from 2027. Together, these changes are expected to cut energy bills for eligible steelmakers by up to £43/MWh, aligning the UK more closely with support available in France and Germany.

2. Steel safeguards – decisive action to strengthen UK trade protections

Business Secretary Jonathan Reynolds has acted to tighten the UK’s steel import quotas, going beyond the Trade Remedies Authority’s recommendations. His decision limits quota liberalisation to just 0.1%, introduces caps on residual quotas, and curtails rollover flexibilities. These changes bring the UK regime in line with EU measures and are aimed at preventing surges in diverted imports, particularly in response to evolving trade policy in the United States.

3. A new Trade Strategy – consultation on a new long-term safeguard regime

Alongside these immediate safeguard decisions, Government has launched a call for evidence on the design of a new mechanism to replace existing steel import protections, which are set to expire in June 2026. This forms part of the wider UK Trade Strategy and reflects a recognition that long-term investment in steel requires certainty about the policy environment.

4. Procurement – new obligations to prioritise UK-made steel in public projects

The updated Procurement Policy Note introduces two important changes: mandatory use of the UK Steel Digital Catalogue before design and procurement decisions, and formal consideration of national security exemptions under the Procurement Act 2023. These obligations apply across government and must be cascaded through supply chains. Crucially, the definition of national security now includes energy resilience, critical infrastructure and economic stability – creating a clearer pathway for UK steel to be prioritised in public projects.

Minister for Industry Sarah Jones highlighted the series of recent wins for the industry and outlined the need for a long-term vision for the sector to deliver a bright, sustainable future for UK steelmaking.

Together, these developments show a clear shift in tone and ambition from Government when it comes to the future of UK steel. It’s a welcoming sign that the Government is listening to the industry’s needs and our policy asks.

We welcome the progress made and look forward to continued engagement on the issues that matter most to the sector — from long-term energy affordability to the design of a credible trade defence regime.

About Tata Steel UK

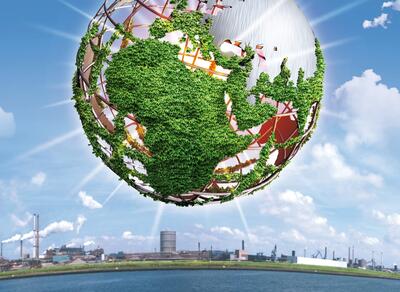

- The Tata Steel Group has been named one of the most ethical companies in the world, and is among the top producing global steel companies with an annual crude steel capacity of 34 million tonnes.

Tata Steel in the UK has the ambition to produce net-zero steel by 2045 at the latest, and to have reduced 30% of its CO2 emissions by 2030. - In October 2024, Tata Steel ceased ironmaking at its Port Talbot site and temporarily paused steelmaking pending the construction of a 3.2Mtpa Electric Arc Furnace, due to be commissioned late in 2027 / early 2028. For that period, the business will import slab and hot rolled coil to support manufacturing and distribution operations at sites across Wales, England and Northern Ireland as well as Norway, Sweden, France, Germany and UAE. It also benefits from a network of sales offices around the world.

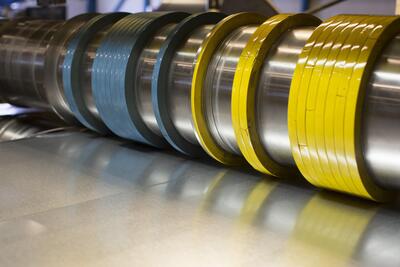

- Throughout 2024 Tata Steel UK has been undergoing a restructuring that will reduce the size of its workforce to around 5000 direct employees, supplying high-quality steel products to demanding markets, including construction and infrastructure, automotive, packaging and engineering.

- Tata Steel Group is one of the world's most geographically-diversified steel producers, with operations and a commercial presence across the world.

- The group recorded a consolidated turnover of around US$26 billion in the financial year ending March 31, 2025.